Elon Musk’s brother suddenly sells $28 million worth of Tesla shares: What’s happening to the billion-dollar empire?

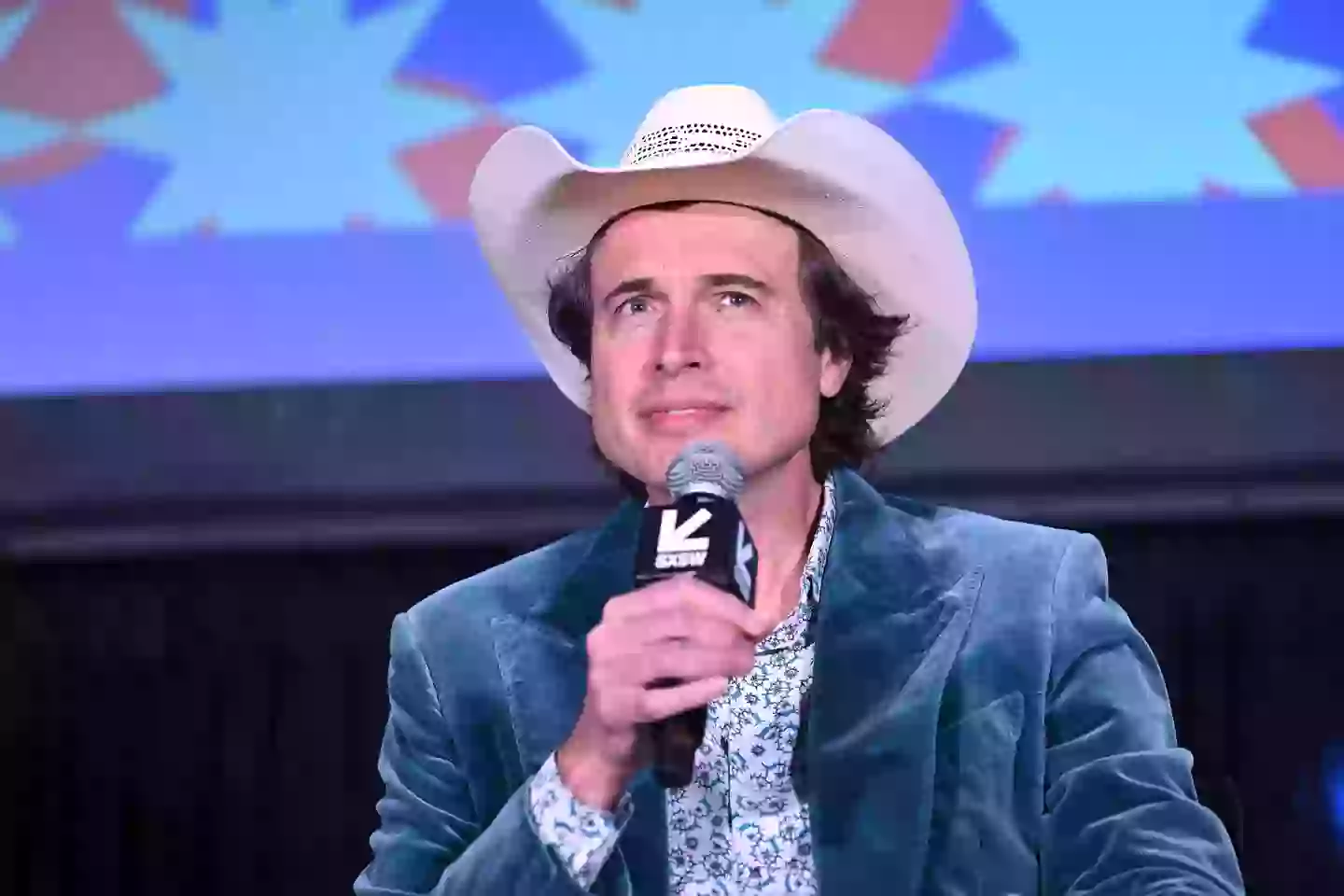

In a surprising move that has grabbed headlines worldwide, Kimbal Musk, brother of Tesla CEO Elon Musk, recently sold approximately $28 million worth of Tesla shares.

The unexpected transaction has surprised investors, analysts and Tesla enthusiasts, leading many to wonder whether trouble is ahead for Musk’s business empire.

Understanding Kimbal Musk’s Tesla Stock Sale

Kimbal Musk, who sits on Tesla’s board of directors, executed the massive sale over several days, according to documents filed with the Securities and Exchange Commission (SEC).

While insider selling is not inherently unusual, the timing and size of this particular transaction have raised considerable speculation and concern.

Kimbal sold approximately 100,000 shares at an average price of $280 each, representing a total of about $28 million.

The sale represents a substantial portion of his holdings and has raised questions about his confidence in Tesla’s immediate and long-term prospects.

Why did Kimbal Musk sell Tesla shares?

A number of factors could have motivated such a substantial sale. Analysts suggest it could be linked to personal financial planning or strategic asset diversification.

Given Kimbal’s well-known investments in food sustainability ventures, it’s plausible that proceeds from the sale could be channeled into other areas he passionately advocates for.

However, critics argue that the move could signal a decline in confidence in Tesla’s growth trajectory.

Amid intensifying competition in the electric vehicle market from brands such as Ford, Volkswagen and emerging Chinese manufacturers, Tesla faces significant challenges in maintaining its market lead.

Rising interest rates, supply chain disruptions and increasing regulatory scrutiny also pose potential threats to Tesla’s profitability and market valuation.

Impact on Tesla shares and market reaction

Tesla shares fell slightly following news of the transaction, highlighting the market’s sensitivity to insider trading activity.

Investors often interpret insider sales (particularly those made by close relatives of company executives) as a bearish indicator.

However, market experts caution against jumping to conclusions. “A financial decision by one person, even someone as prominent as Kimbal Musk, does not necessarily reflect the fundamentals of a company,” says Sarah Jackson, a senior analyst at MarketWatch.

Still, investors remain cautious and are closely watching for any further internal moves or corporate announcements that might validate underlying concerns.

The Musk Empire: From Strength to Uncertainty?

Elon Musk’s companies, from Tesla and SpaceX to Neuralink and X Corp., have been widely regarded as symbols of innovation and futuristic ambition.

Tesla, in particular, reached a market capitalization of $1 trillion, marking a significant milestone in Musk’s empire. However, recent events have sparked talk of potential vulnerabilities at the massive company.

With Elon Musk increasingly dividing his attention between multiple high-profile projects, including his controversial leadership role at Twitter, critics are questioning whether he can maintain momentum across all platforms.

Any hint of internal instability or diminishing trust among insiders like Kimbal could amplify investor concerns about Tesla’s strategic direction.

Industry challenges and competitive pressure

Tesla’s meteoric rise has profoundly transformed the automotive industry, prompting traditional automakers to step up their efforts in producing electric vehicles.

Brands like General Motors, Ford, BMW and newcomers like Lucid Motors and Rivian have increased competition, significantly reducing Tesla’s once-unchallenged lead.

In addition, increasing regulatory requirements globally have put additional pressure on Tesla’s manufacturing processes, particularly around autonomous driving safety and battery production.

Recent recalls and software updates have increased scrutiny, highlighting the challenges Tesla faces in maintaining its premium reputation and operational excellence.

Expert opinions: Bullish or bearish?

Financial experts are divided on Tesla’s future. Renowned financial analyst David Thompson of Goldman Sachs maintains a bullish stance, stating that “Tesla continues to lead innovation and maintains significant technological and infrastructure advantages.”

He advises investors to view Kimbal Musk’s sale as a routine financial decision rather than an indicator of underlying problems.

By contrast, noted economist and Tesla skeptic Linda Stewart argues: “This sale could signal underlying skepticism about Tesla’s current valuation and growth prospects. With Elon Musk’s

attention spread across multiple ventures, Tesla may struggle to maintain its past growth rates.”

Investors should closely watch upcoming quarterly earnings reports, Tesla’s progress in meeting production targets, especially at its gigafactories in Berlin and Texas, and updates on battery innovations such as the highly anticipated 4680 battery cells.

In addition, announcements related to advances or setbacks in autonomous driving technology will significantly influence investor sentiment and stock performance.

Additionally, any other insider transactions, particularly by senior executives or board members, will provide valuable insight into insider perspectives on Tesla’s future.

Greater transparency from Tesla’s leadership in addressing market concerns will also be critical to maintaining investor confidence.

The broader context of insider trading

Insider sales, especially in significant amounts, often attract attention because of their potential implications for the health of the company.

However, it is important to remember that executives and board members often sell stock for reasons unrelated to company performance, such as tax obligations, personal diversification, estate planning, or funding philanthropic efforts.

In the case of Kimbal Musk, his long-standing commitment to philanthropy and sustainable food projects may in fact suggest motivations that go beyond mere profit-making or a lack of faith in Tesla’s future.

Conclusion: Navigating in uncertain waters

Ultimately, Kimbal Musk’s significant stock sale raises valid questions, but it doesn’t conclusively indicate that there are deeper problems within Tesla.

While it has understandably sparked debates about trust and strategy, Tesla’s innovative track record, technological leadership and continued global growth ambitions remain important pillars of its value proposition.

Investors and analysts alike will continue to closely monitor developments, looking for signs that confirm or dispel fears about Tesla’s future.

Tesla’s ability to navigate competitive pressures, regulatory hurdles and internal strategic management will decisively shape perceptions and determine the lasting impact of internal actions such as Kimbal Musk’s remarkable stock sale.

For now, Musk’s trillion-dollar empire remains robust but vulnerable, with eyes firmly on every move of his influencers and the strategic decisions that shape his path forward.